Understanding Who Closes on the Mortgage Loan Commitment at Closing: A Comprehensive Guide

Guide or Summary:IntroductionThe Role of the Mortgage Loan CommitmentWho is Involved in the Closing Process?Steps in the Closing Process**Translation:** Who……

Guide or Summary:

- Introduction

- The Role of the Mortgage Loan Commitment

- Who is Involved in the Closing Process?

- Steps in the Closing Process

**Translation:** Who closes on the mortgage loan commitment at closing

---

Introduction

When embarking on the journey of homeownership, one of the most critical steps in the process is understanding the mortgage loan commitment. A common question that arises is, who closes on the mortgage loan commitment at closing? This question is essential for homebuyers, real estate agents, and even lenders, as it can significantly impact the overall closing process and the smooth transition into a new home.

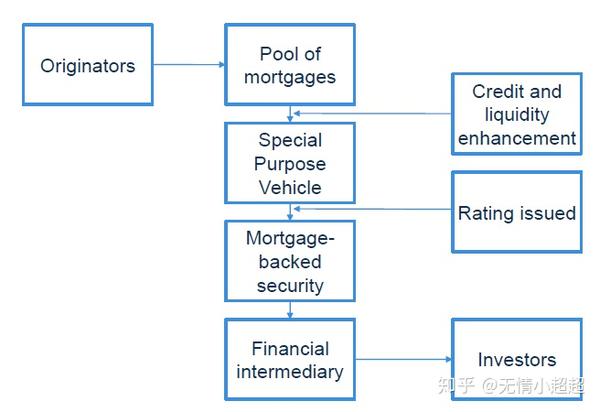

The Role of the Mortgage Loan Commitment

Before delving into the specifics of who is involved in closing, it’s important to understand what a mortgage loan commitment is. A mortgage loan commitment is a formal offer from a lender to provide a borrower with a loan under specific terms and conditions. This document outlines the amount of money the lender is willing to loan, the interest rate, and any other stipulations that must be met before the loan is finalized.

Who is Involved in the Closing Process?

The closing process involves several key players, each with distinct roles. Primarily, the individuals who close on the mortgage loan commitment at closing include:

1. **The Borrower:** This is the individual or individuals applying for the mortgage. They are responsible for providing necessary documentation and fulfilling the lender's requirements.

2. **The Lender:** The financial institution providing the mortgage loan. They review the borrower's application, assess risk, and ultimately decide whether to approve the loan.

3. **The Closing Agent:** This could be an attorney or a title company representative responsible for overseeing the closing process. They ensure that all documents are correctly executed and that funds are appropriately distributed.

4. **Real Estate Agents:** While not directly involved in closing the mortgage, real estate agents facilitate communication between the buyer and seller and can help navigate any issues that arise during the process.

5. **Title Company:** This entity ensures that the title of the property is clear of any liens or legal issues. They also provide title insurance to protect against future claims on the property.

Steps in the Closing Process

Understanding who closes on the mortgage loan commitment at closing requires familiarity with the steps involved in the closing process:

1. **Finalizing the Loan Application:** Once the borrower has submitted their application and received a loan commitment, they must finalize the details with the lender.

2. **Reviewing Closing Documents:** The closing agent will prepare necessary documents, including the Closing Disclosure, which outlines the final terms of the loan, and the deed.

3. **Conducting the Closing Meeting:** During the closing meeting, all parties involved gather to review and sign the documents. The borrower will need to provide valid identification and any remaining funds required for closing costs.

4. **Disbursing Funds:** After all documents are signed, the lender will disburse the loan funds, and the closing agent will ensure that all parties receive their respective payments.

5. **Recording the Transaction:** Finally, the closing agent will record the transaction with the local government to officially transfer ownership of the property.

In summary, understanding who closes on the mortgage loan commitment at closing is crucial for anyone involved in the home buying process. Each participant plays a vital role in ensuring a smooth and successful closing. By familiarizing oneself with the various roles and steps involved, borrowers can navigate the complexities of obtaining a mortgage and securing their new home with confidence. Whether you are a first-time homebuyer or a seasoned investor, knowing the ins and outs of the closing process will empower you to make informed decisions and avoid potential pitfalls.