Unlocking Your Retail Success: A Comprehensive Guide to Retail Business Loans

Guide or Summary:Understanding Retail Business LoansTypes of Retail Business LoansThe Benefits of Retail Business LoansChoosing the Right Retail Business Lo……

Guide or Summary:

- Understanding Retail Business Loans

- Types of Retail Business Loans

- The Benefits of Retail Business Loans

- Choosing the Right Retail Business Loan

**Retail Business Loans** (零售商业贷款) are essential financial tools that can help entrepreneurs and business owners in the retail sector to grow their operations, manage cash flow, and invest in new opportunities. In today’s competitive market, having access to sufficient capital is crucial for sustaining and expanding a retail business. This article will explore the various types of retail business loans available, their benefits, and how to choose the right loan for your specific needs.

Understanding Retail Business Loans

Retail business loans are specialized financing options designed to meet the unique needs of retail businesses. These loans can be used for a variety of purposes, including purchasing inventory, renovating storefronts, hiring staff, or launching marketing campaigns. Understanding the different types of retail business loans can help you make informed decisions about which option is best for your business.

Types of Retail Business Loans

There are several types of retail business loans available, each with its own set of features and benefits. Here are some of the most common options:

1. **Term Loans**: These are traditional loans that provide a lump sum of capital upfront, which must be repaid over a specified period, usually with fixed monthly payments. Term loans are ideal for larger purchases or long-term investments.

2. **Lines of Credit**: A line of credit offers more flexibility, allowing businesses to borrow money as needed up to a certain limit. This option is great for managing cash flow fluctuations and covering unexpected expenses.

3. **Inventory Financing**: This type of loan is specifically designed for purchasing inventory. Retailers can use their inventory as collateral to secure funding, making it easier to stock up on products without straining cash flow.

4. **Merchant Cash Advances**: This option provides a lump sum of cash in exchange for a percentage of future credit card sales. It’s a quick way to access funds, but it often comes with higher fees and interest rates.

5. **SBA Loans**: The Small Business Administration (SBA) offers various loan programs that can be beneficial for retail businesses. These loans typically have lower interest rates and longer repayment terms, making them an attractive option for many entrepreneurs.

The Benefits of Retail Business Loans

Utilizing retail business loans can provide several advantages for your business:

- **Cash Flow Management**: Access to funds can help you maintain a steady cash flow, ensuring that you can cover operational expenses and invest in growth opportunities.

- **Expansion Opportunities**: With sufficient financing, you can expand your retail space, open new locations, or diversify your product offerings.

- **Inventory Management**: Retail business loans can help you purchase inventory in bulk, allowing you to take advantage of discounts and improve your profit margins.

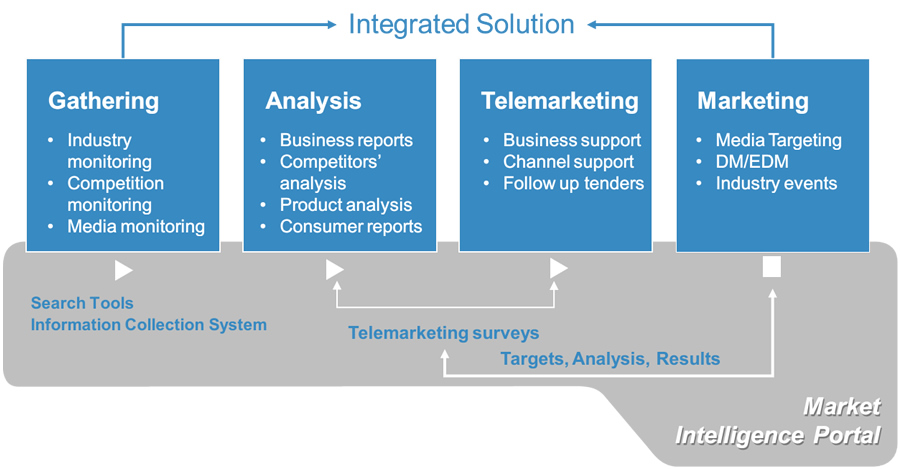

- **Marketing and Promotion**: Investing in marketing campaigns can drive customer traffic to your store, and loans can provide the necessary funds to implement effective strategies.

Choosing the Right Retail Business Loan

When selecting a retail business loan, consider the following factors:

- **Loan Amount and Terms**: Determine how much funding you need and the repayment terms that will work best for your cash flow situation.

- **Interest Rates**: Compare interest rates from various lenders to find the most cost-effective option.

- **Eligibility Requirements**: Review the eligibility criteria for each loan type to ensure you qualify.

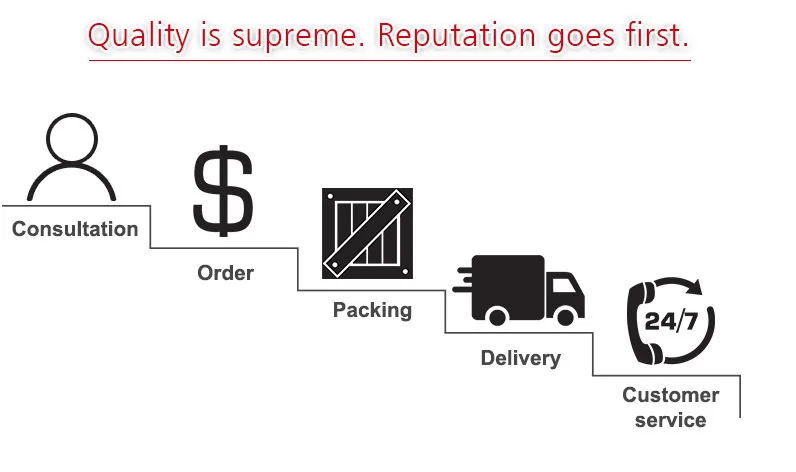

- **Lender Reputation**: Research lenders to find those with positive reviews and a track record of helping businesses succeed.

In conclusion, **retail business loans** (零售商业贷款) are a vital resource for retail entrepreneurs looking to grow and thrive in a competitive marketplace. By understanding the types of loans available and their benefits, you can make informed decisions that will support your business goals. Whether you need funds for inventory, marketing, or expansion, the right retail business loan can help you unlock your retail success.