"Understanding Equity Loan Rates in Massachusetts: A Comprehensive Guide to Your Financing Options"

Guide or Summary:Equity Loan Rates MassachusettsWhat is an Equity Loan?Factors Influencing Equity Loan Rates in MassachusettsCurrent Trends in Equity Loan R……

Guide or Summary:

- Equity Loan Rates Massachusetts

- What is an Equity Loan?

- Factors Influencing Equity Loan Rates in Massachusetts

- Current Trends in Equity Loan Rates in Massachusetts

- Benefits of Equity Loans

- How to Secure the Best Equity Loan Rates in Massachusetts

Equity Loan Rates Massachusetts

When considering financing options for home improvements, debt consolidation, or major purchases, many homeowners in Massachusetts turn to equity loans. But what exactly are equity loan rates in Massachusetts, and how can they affect your financial decisions? In this guide, we will explore the intricacies of equity loans, including their rates, benefits, and how to secure the best deal.

What is an Equity Loan?

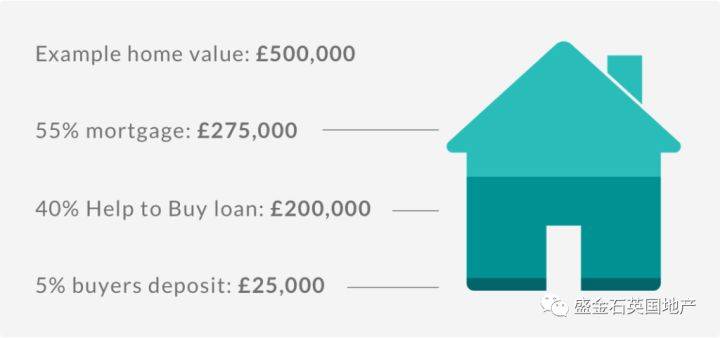

An equity loan, often referred to as a home equity loan or second mortgage, allows homeowners to borrow against the equity they have built in their property. Equity is the difference between the current market value of your home and the amount you owe on your mortgage. For example, if your home is worth $400,000 and you owe $250,000, your equity is $150,000. Lenders typically allow you to borrow a percentage of this equity, often up to 80% or more, depending on various factors.

Factors Influencing Equity Loan Rates in Massachusetts

The rates for equity loans can vary significantly based on several factors. In Massachusetts, the following elements play a crucial role in determining the equity loan rates:

1. **Credit Score**: Lenders use your credit score to assess your creditworthiness. A higher credit score often translates to lower interest rates.

2. **Loan-to-Value Ratio (LTV)**: This ratio compares the loan amount to the appraised value of your home. A lower LTV ratio generally results in better rates.

3. **Market Conditions**: Economic factors, including inflation and the Federal Reserve's interest rate policies, can influence overall lending rates.

4. **Loan Amount and Term**: The size of the loan and the repayment term can also affect the interest rate. Shorter terms usually come with lower rates.

5. **Lender Policies**: Different lenders have varying policies and fee structures, which can impact the overall cost of the loan.

Current Trends in Equity Loan Rates in Massachusetts

As of late 2023, equity loan rates in Massachusetts have seen fluctuations due to changing economic conditions. Homeowners looking to tap into their home equity should stay informed about current market trends. Many lenders are offering competitive rates, especially for those with excellent credit. It’s advisable to shop around and compare offers from different lenders to find the best rate available.

Benefits of Equity Loans

Equity loans can provide homeowners with several advantages:

- **Lower Interest Rates**: Compared to credit cards and personal loans, equity loans often come with lower interest rates, making them a cost-effective borrowing option.

- **Tax Deductibility**: In some cases, the interest paid on equity loans may be tax-deductible, adding to their financial appeal.

- **Fixed Payments**: Many equity loans offer fixed interest rates, allowing for predictable monthly payments over the loan term.

- **Large Borrowing Amounts**: Homeowners can often borrow substantial amounts, making equity loans suitable for significant expenses.

How to Secure the Best Equity Loan Rates in Massachusetts

To ensure you get the best equity loan rates in Massachusetts, consider the following steps:

1. **Improve Your Credit Score**: Before applying for a loan, check your credit report and take steps to improve your score if necessary.

2. **Shop Around**: Don’t settle for the first offer. Compare rates from multiple lenders, including banks, credit unions, and online lenders.

3. **Consider a Co-Signer**: If your credit isn’t great, having a co-signer with a better credit profile can help you secure a lower rate.

4. **Negotiate**: Don’t hesitate to negotiate with lenders. Some may be willing to lower their rates or fees to win your business.

5. **Stay Informed**: Keep an eye on market trends and economic forecasts that could impact interest rates.

In conclusion, understanding equity loan rates in Massachusetts is essential for homeowners looking to leverage their home equity. By considering the factors that influence these rates and taking proactive steps to secure the best deal, you can make informed financial decisions that benefit your long-term financial health.