Unlocking Financial Freedom: How Truist Student Loan Can Help You Manage College Expenses

#### What is Truist Student Loan?Truist Student Loan is a financial product designed to assist students in funding their higher education. With rising tuiti……

#### What is Truist Student Loan?

Truist Student Loan is a financial product designed to assist students in funding their higher education. With rising tuition costs and living expenses, many students find themselves in need of financial assistance to complete their degrees. Truist, a well-known banking institution, offers a variety of loan options tailored to meet the diverse needs of students, ensuring that they can focus on their studies without the burden of financial stress.

#### Benefits of Truist Student Loan

One of the primary advantages of the Truist Student Loan is its competitive interest rates. Unlike many private loans that can carry high-interest rates, Truist offers rates that are often more manageable, making repayment easier for graduates. Additionally, the loan terms are flexible, allowing students to choose a repayment plan that best fits their financial situation post-graduation.

Another significant benefit is the potential for deferment options. Students who may face financial difficulties after graduation can often defer their payments for a certain period, providing them with the breathing room they need to secure employment and establish financial stability.

#### How to Apply for Truist Student Loan

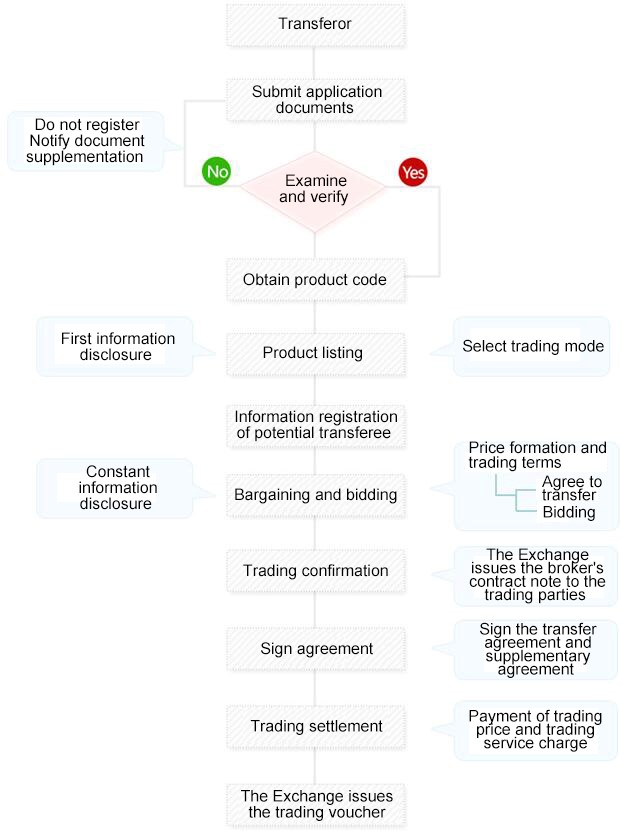

Applying for a Truist Student Loan is a straightforward process. Interested students can start by visiting the Truist website, where they can find detailed information about the loan products available. The application process typically requires personal information, including income details, credit history, and the cost of attendance at the chosen educational institution.

Once the application is submitted, Truist will review the information and determine eligibility. If approved, students will receive a loan offer outlining the terms and conditions, including interest rates and repayment options. It is essential for students to read this information carefully and ask questions if they need clarification before accepting the loan.

#### Managing Your Truist Student Loan

Once you have secured a Truist Student Loan, managing it effectively is crucial to maintaining your financial health. Here are some tips to consider:

1. **Create a Budget**: Understanding your income and expenses will help you manage your loan repayments effectively. Allocate a portion of your income to cover monthly payments, ensuring you stay on track.

2. **Stay Informed**: Keep track of your loan balance, interest rates, and repayment terms. This knowledge will empower you to make informed decisions about your finances.

3. **Consider Automatic Payments**: Setting up automatic payments can help you avoid late fees and keep your credit score intact. Many lenders, including Truist, offer interest rate reductions for borrowers who choose this option.

4. **Explore Repayment Plans**: If you find yourself struggling to make payments, contact Truist to discuss alternative repayment options. They may offer income-driven repayment plans or other solutions to help you manage your debt.

5. **Utilize Resources**: Truist provides various resources for borrowers, including financial education materials and counseling services. Take advantage of these tools to enhance your financial literacy and make informed decisions.

#### Conclusion

In conclusion, the Truist Student Loan is a valuable resource for students seeking financial assistance to pursue their educational goals. With its competitive rates, flexible terms, and supportive resources, Truist is committed to helping students navigate the complexities of financing their education. By understanding the loan process and managing repayments effectively, students can achieve financial freedom and focus on what truly matters—earning their degree and preparing for a successful future.