Understanding Loan Fees Amortization: A Comprehensive Guide to Managing Your Loan Costs

#### What is Loan Fees Amortization?Loan fees amortization refers to the process of spreading out the costs associated with a loan over the life of the loan……

#### What is Loan Fees Amortization?

Loan fees amortization refers to the process of spreading out the costs associated with a loan over the life of the loan. These costs, often referred to as loan fees, can include origination fees, appraisal fees, and other related expenses that borrowers incur when taking out a loan. Amortization allows borrowers to manage these costs effectively, making it easier to budget for monthly payments and understand the total financial commitment involved in the loan.

#### The Importance of Understanding Loan Fees

When taking out a loan, understanding the associated fees is crucial. Loan fees can significantly impact the overall cost of borrowing. For example, a higher origination fee can lead to higher monthly payments, which can strain your budget. By understanding loan fees amortization, borrowers can make informed decisions about which loan products to choose and how to manage their payments over time.

#### How Loan Fees Amortization Works

![]()

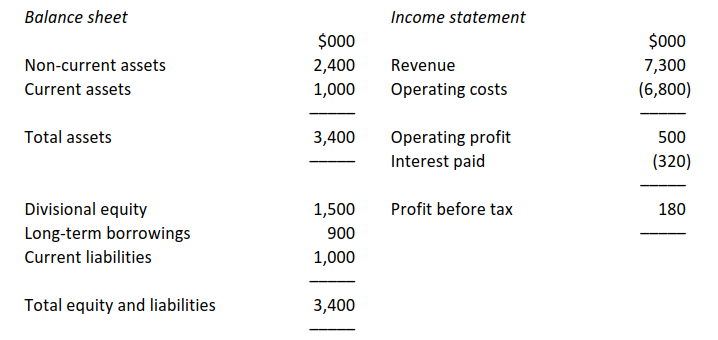

Loan fees amortization typically involves calculating the total loan fees and then distributing those costs evenly across the loan's term. For instance, if you take out a $200,000 mortgage with $4,000 in fees and a 30-year term, your monthly payment will include a portion of those fees. This process helps borrowers see the true cost of their loan and allows them to plan their finances accordingly.

#### Calculating Your Loan Fees Amortization

To calculate loan fees amortization, you need to know the total loan fees, the loan amount, and the term of the loan. The formula involves dividing the total fees by the number of months in the loan term. This calculation will give you the monthly fee that will be added to your principal and interest payment. Understanding this calculation can help you assess the affordability of a loan and compare different loan offers.

#### Strategies for Managing Loan Fees

1. **Shop Around**: Different lenders offer varying loan fees. By shopping around, you can find a loan with lower fees, which can save you money in the long run.

2. **Negotiate Fees**: Some fees may be negotiable. Don't hesitate to ask your lender if they can reduce certain fees or offer a better deal.

3. **Consider the Total Cost**: When evaluating loans, consider the total cost of borrowing, including loan fees amortization. A loan with a lower interest rate but higher fees may not be the best choice.

4. **Refinance**: If you find yourself with a loan that has high fees, consider refinancing. This can help you secure a better rate and lower your overall loan costs.

#### Conclusion

Understanding loan fees amortization is essential for anyone considering taking out a loan. By being aware of the fees involved and how they affect your monthly payments, you can make more informed financial decisions. Take the time to research your options, calculate your potential costs, and choose a loan that fits your budget and financial goals. With the right knowledge and strategies, you can effectively manage your loan fees and minimize your borrowing costs.