Understanding Home Loan Pre Approval with Capital One: A Comprehensive Guide

#### Home Loan Pre Approval Capital OneHome loan pre approval is a crucial step for anyone looking to purchase a home. It provides potential buyers with a c……

#### Home Loan Pre Approval Capital One

Home loan pre approval is a crucial step for anyone looking to purchase a home. It provides potential buyers with a clear understanding of how much they can borrow, streamlining the home buying process. Capital One, a well-known financial institution, offers a robust pre approval process that can help you navigate the complexities of obtaining a mortgage.

#### What is Home Loan Pre Approval?

Home loan pre approval is the process by which a lender evaluates your financial situation to determine how much money you can borrow for a mortgage. This involves a thorough review of your credit history, income, debts, and assets. Once approved, you receive a pre approval letter, which indicates the maximum loan amount you qualify for. This letter can significantly enhance your credibility as a buyer, making you more attractive to sellers.

#### The Benefits of Getting Pre Approved with Capital One

1. **Clarity on Budget**: Knowing your pre approved loan amount helps you set a realistic budget when searching for a home. This prevents you from wasting time looking at properties that are out of your financial reach.

2. **Stronger Negotiating Power**: Sellers are more likely to take your offers seriously when you have a pre approval letter from a reputable lender like Capital One. It demonstrates that you are a serious buyer with the financial backing to make a purchase.

3. **Faster Closing Process**: With pre approval, much of the paperwork and verification is completed ahead of time, which can expedite the closing process once you find a home.

4. **Access to Better Rates**: Capital One often provides competitive interest rates, which can save you money over the life of your loan. Being pre approved may also position you better for favorable terms.

#### How to Get Pre Approved with Capital One

1. **Gather Your Financial Documents**: Before applying for pre approval, collect necessary documents such as pay stubs, tax returns, bank statements, and information on any debts you have.

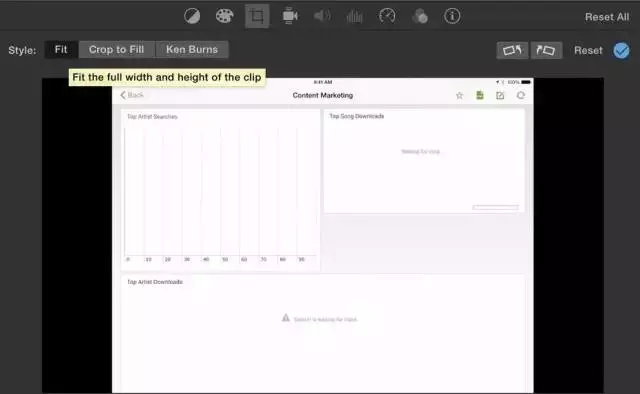

2. **Apply Online or In-Person**: Capital One offers a user-friendly online application process, or you can visit a local branch to speak with a representative.

3. **Review Your Credit Score**: Capital One will check your credit score as part of the pre approval process. It’s a good idea to review your credit report beforehand to address any discrepancies.

4. **Receive Your Pre Approval Letter**: If you meet the criteria, Capital One will issue a pre approval letter detailing the amount you are qualified to borrow.

#### Conclusion

Home loan pre approval with Capital One is an essential step for prospective homebuyers. It not only clarifies your budget but also strengthens your position in the competitive real estate market. By understanding the pre approval process and the benefits it offers, you can approach your home buying journey with confidence. Whether you’re a first-time buyer or looking to upgrade, securing a pre approval can make a significant difference in your experience. Make sure to explore your options with Capital One and take the first step towards homeownership today!