Discover the Best Loans in Raleigh, NC: Unlock Your Financial Potential

Guide or Summary:Why Choose Loans in Raleigh, NC?Types of Loans AvailableBenefits of Local LendersHow to Choose the Right Loan for YouApplying for Loans in……

Guide or Summary:

- Why Choose Loans in Raleigh, NC?

- Types of Loans Available

- Benefits of Local Lenders

- How to Choose the Right Loan for You

- Applying for Loans in Raleigh, NC

Are you on the lookout for reliable financial solutions? Look no further! When it comes to securing loans in Raleigh, NC, you have a myriad of options tailored to fit your needs. Whether you're a first-time homebuyer, looking to refinance, or simply in need of extra cash for unexpected expenses, Raleigh offers a variety of loan products that can help you achieve your financial goals.

Why Choose Loans in Raleigh, NC?

Raleigh, the capital of North Carolina, is not just known for its rich history and vibrant culture; it's also a hub for financial services. The city's growing economy and diverse population make it an ideal place for lenders to offer competitive loan products. By choosing loans in Raleigh, NC, you benefit from local lenders who understand the unique needs of the community.

Types of Loans Available

1. **Personal Loans**: Whether you need funds for medical expenses, home renovations, or a dream vacation, personal loans in Raleigh can provide you with the cash you need quickly and efficiently.

2. **Home Loans**: The housing market in Raleigh is thriving. If you're ready to buy your first home or upgrade to a larger space, explore the various home loan options available, including FHA loans, VA loans, and conventional mortgages.

3. **Auto Loans**: Looking to purchase a new or used vehicle? Local lenders in Raleigh offer auto loans with competitive interest rates and flexible terms to help you drive away in your dream car.

4. **Business Loans**: For entrepreneurs and small business owners, Raleigh provides access to various business loans, including SBA loans, lines of credit, and equipment financing. These loans can help you expand your business and reach new heights.

Benefits of Local Lenders

Choosing local lenders for your loans in Raleigh, NC comes with several advantages. Local lenders often have a better understanding of the local market and can provide personalized service tailored to your financial situation. Additionally, they may offer more flexible terms and lower fees compared to larger national banks.

How to Choose the Right Loan for You

When searching for loans in Raleigh, NC, it’s essential to consider several factors to ensure you make the best choice:

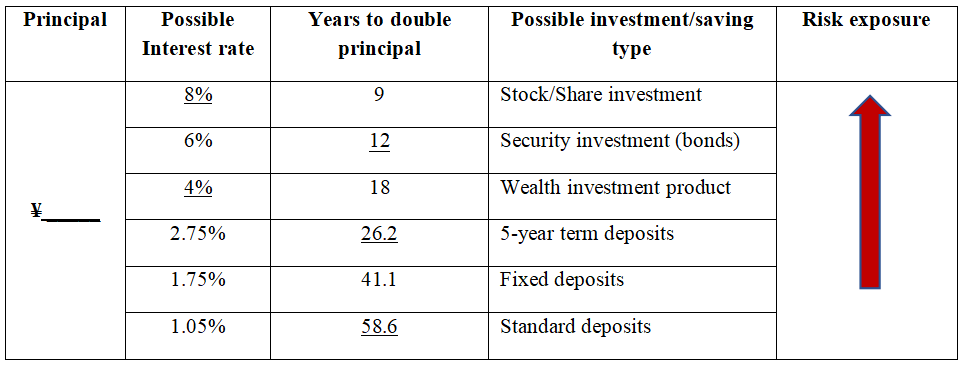

- **Interest Rates**: Compare rates from different lenders to find the most favorable terms.

- **Loan Terms**: Look at the repayment period and ensure it aligns with your financial capabilities.

- **Fees**: Be aware of any origination fees, closing costs, or other charges that may apply.

- **Customer Reviews**: Research customer experiences to gauge the lender's reliability and service quality.

Applying for Loans in Raleigh, NC

The application process for loans in Raleigh, NC is typically straightforward. Most lenders allow you to apply online, making it convenient to submit your application from the comfort of your home. You'll need to provide necessary documentation, such as proof of income, credit history, and identification.

In summary, if you're considering financial assistance, exploring loans in Raleigh, NC can open the door to numerous opportunities. With a variety of loan products available and local lenders ready to assist you, achieving your financial dreams is within reach. Don’t hesitate—start your journey towards financial empowerment today!