Unlock Your Financial Freedom with a 5000 Personal Loan - Your Path to Immediate Cash Relief

#### Description:In today's fast-paced world, financial emergencies can arise unexpectedly, leaving many individuals in need of immediate cash solutions. If……

#### Description:

In today's fast-paced world, financial emergencies can arise unexpectedly, leaving many individuals in need of immediate cash solutions. If you're facing such a situation, a 5000 personal loan could be the answer to your financial woes. This type of loan offers a quick and accessible way to secure the funds you need, whether it's for medical expenses, home repairs, or consolidating debt.

A 5000 personal loan is designed to provide borrowers with a manageable amount of money that can be paid back over a predetermined period. With competitive interest rates and flexible repayment terms, this loan option is appealing to many. It caters to individuals who may not have access to larger sums of money but still require significant financial assistance.

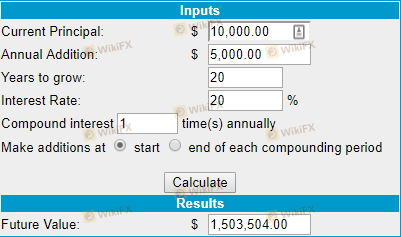

When considering a 5000 personal loan, it's essential to understand the various lending options available. You can choose from traditional banks, credit unions, or online lenders. Each lender may have different requirements, interest rates, and terms, so it's crucial to shop around and compare your options. Look for lenders who offer transparent terms and conditions, as well as tools to help you calculate your potential monthly payments.

One of the significant advantages of a 5000 personal loan is the speed at which you can access funds. Many lenders offer quick approval processes, allowing you to receive your money within days of your application. This is especially beneficial in emergencies where time is of the essence. Additionally, the application process is often straightforward, requiring minimal documentation, which can further expedite your access to funds.

Another appealing aspect of a 5000 personal loan is the potential for improving your credit score. By responsibly managing your loan and making timely payments, you can demonstrate your creditworthiness, which may lead to better loan terms in the future. This can be particularly advantageous if you plan to make larger purchases, such as a home or a car, down the line.

However, it's essential to approach a 5000 personal loan with caution. Before applying, assess your financial situation and determine whether you can comfortably afford the monthly payments. Borrowing more than you can handle can lead to a cycle of debt that is difficult to escape. Consider creating a budget that includes your loan repayments to ensure you stay on track.

In conclusion, a 5000 personal loan can be a powerful tool for those in need of immediate financial assistance. With its quick access to funds, flexible repayment options, and potential credit score benefits, it is an attractive choice for many borrowers. However, it's vital to do your research, compare lenders, and understand your financial capabilities before committing. Empower yourself with the right information and take control of your financial future today!