How Do You Take Your Name Off a Car Loan? A Comprehensive Guide to Removing Your Name from an Auto Loan Agreement

---**How do you take your name off a car loan?**Removing your name from a car loan can be a necessary step for various reasons, such as divorce, selling the……

---

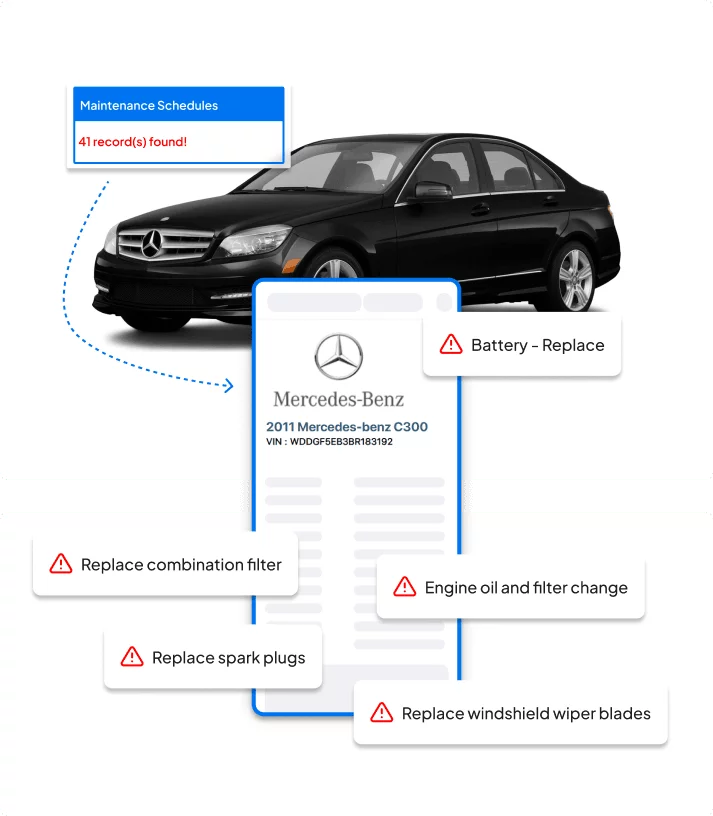

**How do you take your name off a car loan?**

Removing your name from a car loan can be a necessary step for various reasons, such as divorce, selling the vehicle, or simply wanting to transfer financial responsibility. This process may seem daunting, but with the right information and steps, you can navigate it successfully.

#### Understanding the Reasons for Removing Your Name

Before diving into the process, it's essential to understand why you might want to take your name off a car loan. Common reasons include:

- **Divorce or Separation**: Often, couples may need to separate their finances after a split, and removing one partner's name from a shared loan is a crucial step.

- **Selling the Vehicle**: If you are selling your car but the loan is still active, you may want to remove your name to transfer ownership to the new buyer without complications.

- **Financial Independence**: Sometimes, individuals want to disentangle themselves from someone else's financial obligations, especially if the other party has a history of missed payments.

#### Steps to Remove Your Name from a Car Loan

1. **Check the Loan Agreement**: Begin by reviewing the original loan agreement. Some loans have specific clauses regarding name removal, so it's crucial to understand the terms before proceeding.

2. **Communicate with the Co-Borrower**: If you are not the sole borrower, discuss the situation with the co-borrower. They may need to take over the loan entirely or refinance it in their name.

3. **Contact the Lender**: Reach out to your lender to inform them of your intention to remove your name from the loan. They can provide guidance on the necessary steps and inform you about any fees or implications.

4. **Refinancing the Loan**: In many cases, the co-borrower will need to refinance the loan in their name. This process involves applying for a new loan that pays off the existing loan, effectively removing your name from the financial obligation.

5. **Provide Necessary Documentation**: Be prepared to provide any required documentation to the lender, such as proof of income, identification, and possibly a credit check for the co-borrower.

6. **Complete the Transfer**: Once the refinancing is approved, ensure that all paperwork is completed correctly. This may include signing off on the loan and updating the title of the vehicle.

7. **Confirm Removal**: After the process is complete, confirm with the lender that your name has been officially removed from the loan and request a statement verifying this change.

#### Potential Challenges to Consider

While the process may seem straightforward, there can be challenges:

- **Credit Impact**: Removing your name may affect your credit score, especially if the loan has a history of late payments. It's essential to monitor your credit report during this transition.

- **Co-Borrower’s Financial Situation**: If the co-borrower has a poor credit history, they may struggle to refinance, which could complicate your efforts to remove your name.

- **Fees and Penalties**: Some lenders may charge fees for refinancing or transferring the loan, so be sure to inquire about any potential costs upfront.

#### Conclusion

In summary, **how do you take your name off a car loan?** The process involves understanding your reasons, communicating with involved parties, and working with your lender to ensure a smooth transition. By following the steps outlined above, you can successfully remove your name from a car loan and move forward with your financial goals. Always consult with financial professionals if you have concerns or need personalized advice tailored to your situation.