Understanding the Impact of FHA Loan Mortgage Rates on Home Buying Decisions

Guide or Summary:FHA Loan Mortgage RateFHA Loan Mortgage RateThe FHA Loan Mortgage Rate is a critical factor for many homebuyers, particularly first-time bu……

Guide or Summary:

FHA Loan Mortgage Rate

The FHA Loan Mortgage Rate is a critical factor for many homebuyers, particularly first-time buyers and those with lower credit scores. The Federal Housing Administration (FHA) insures these loans, which allows lenders to offer more favorable terms, including lower down payments and competitive interest rates. Understanding how these rates work can significantly influence your home buying journey.

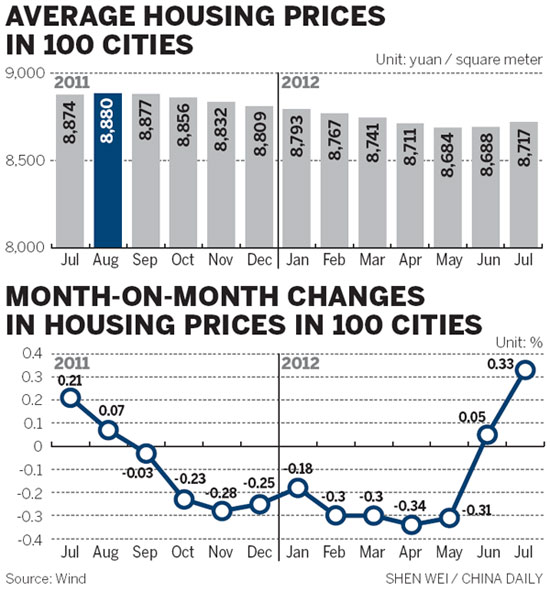

When considering an FHA loan, it's essential to recognize that the FHA Loan Mortgage Rate is often lower than conventional loan rates. This is primarily due to the backing from the FHA, which reduces the lender's risk. As a result, borrowers can access financing options that may otherwise be unavailable to them. However, the FHA Loan Mortgage Rate can fluctuate based on various factors, including market conditions, the borrower's credit score, and the overall economic climate.

One of the most appealing aspects of the FHA Loan Mortgage Rate is the low down payment requirement, which can be as low as 3.5% of the purchase price. This feature makes homeownership more accessible for individuals and families who may not have substantial savings. Additionally, the FHA Loan Mortgage Rate is often accompanied by lower closing costs, further easing the financial burden of purchasing a home.

However, it's important to note that while the FHA Loan Mortgage Rate offers many benefits, there are also some drawbacks. Borrowers are required to pay mortgage insurance premiums (MIP), which can increase the overall cost of the loan. This insurance protects the lender in case of default, but it adds to the monthly payment. Understanding the full impact of these costs is crucial for potential homebuyers.

To make the most informed decision regarding an FHA loan, prospective buyers should shop around for the best FHA Loan Mortgage Rate. Different lenders may offer varying rates and terms, so comparing multiple quotes can lead to significant savings. Additionally, improving your credit score before applying can help secure a lower FHA Loan Mortgage Rate.

In conclusion, the FHA Loan Mortgage Rate plays a vital role in the home buying process. By understanding how it works, the associated costs, and the benefits it offers, potential buyers can make informed decisions that align with their financial goals. Whether you're a first-time buyer or looking to refinance, considering an FHA loan could be a smart move in today's housing market.