Understanding the Impact of Car Loans on Your Credit Score: Does a Car Loan Hurt Credit Score?

**Translation of "does a car loan hurt credit score":** Does a car loan hurt credit score?---When considering a car loan, many potential borrowers often won……

**Translation of "does a car loan hurt credit score":** Does a car loan hurt credit score?

---

When considering a car loan, many potential borrowers often wonder: **Does a car loan hurt credit score?** The answer to this question is multifaceted, as various factors come into play when it comes to credit scores and loans.

**Understanding Credit Scores**

Before delving into how a car loan might affect your credit score, it’s important to understand what a credit score is. A credit score is a numerical representation of your creditworthiness, typically ranging from 300 to 850. The score is influenced by several factors, including your payment history, credit utilization, length of credit history, new credit inquiries, and types of credit in use.

**How Car Loans Affect Credit Scores**

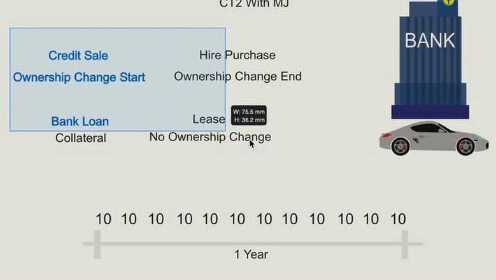

When you take out a car loan, it can impact your credit score in several ways:

1. **Hard Inquiries**

When you apply for a car loan, lenders will perform a hard inquiry on your credit report to assess your creditworthiness. This hard inquiry can cause a slight drop in your credit score, typically by a few points. However, the impact is usually temporary, and your score can recover quickly if you maintain good credit habits.

2. **Credit Utilization**

If you are financing a vehicle, the loan amount will contribute to your total debt load. However, auto loans are often viewed differently than revolving credit (like credit cards) because they are installment loans. While high credit utilization can negatively affect your score, an auto loan is less likely to hurt your score significantly if managed properly.

3. **Payment History**

Your payment history is one of the most significant factors affecting your credit score. Making timely payments on your car loan can help improve your credit score over time. Conversely, late payments or defaults can severely damage your score, making it crucial to stay on top of your loan payments.

4. **Length of Credit History**

Taking out a car loan can also affect the length of your credit history. A longer credit history generally has a positive impact on your credit score. If this is one of your first loans, it may initially lower your score, but over time, it can contribute positively to your credit profile.

5. **Diversity of Credit Types**

Having a mix of credit types—such as revolving credit (credit cards) and installment loans (like car loans)—can benefit your credit score. A car loan may diversify your credit profile, which can be advantageous in the long run.

**Conclusion**

So, does a car loan hurt credit score? The answer is not straightforward. While a car loan can initially cause a slight dip in your credit score due to hard inquiries and increased debt load, responsible management of the loan can lead to long-term benefits. Staying consistent with your payments and maintaining a healthy credit mix can enhance your credit profile over time. Ultimately, the key is to approach car loans with careful planning and awareness of how they fit into your overall financial strategy.