Understanding Home Equity Loan Percentage Rates: What You Need to Know Before Borrowing

#### Home Equity Loan Percentage RatesHome equity loans have become a popular financial tool for homeowners looking to leverage the value of their property……

#### Home Equity Loan Percentage Rates

Home equity loans have become a popular financial tool for homeowners looking to leverage the value of their property. One of the most critical factors to consider when taking out a home equity loan is the **home equity loan percentage rates**. These rates can significantly influence the total cost of borrowing and the monthly payments you will need to make.

#### What Are Home Equity Loans?

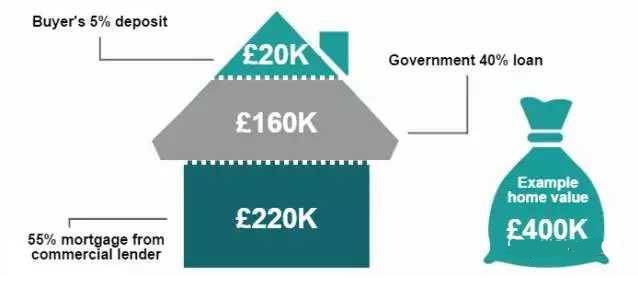

A home equity loan is a type of loan that allows homeowners to borrow against the equity they have built up in their property. Equity is the difference between the current market value of your home and the amount you owe on your mortgage. For example, if your home is worth $300,000 and you owe $200,000, your equity is $100,000. Lenders typically allow you to borrow a percentage of this equity, often up to 85%.

#### Importance of Home Equity Loan Percentage Rates

The **home equity loan percentage rates** are crucial because they determine the interest you will pay on the borrowed amount. These rates can vary widely based on several factors, including your credit score, the lender's policies, and the overall economic environment. Typically, home equity loan rates are lower than unsecured loans because they are secured by your home.

#### Factors Influencing Home Equity Loan Percentage Rates

Several factors can influence the percentage rates on home equity loans:

1. **Credit Score**: Lenders assess your creditworthiness through your credit score. A higher score can lead to lower interest rates, while a lower score might result in higher rates or even denial of the loan application.

2. **Loan-to-Value Ratio (LTV)**: This ratio compares the amount of your loan to the appraised value of your home. A lower LTV ratio may qualify you for better rates, as it indicates less risk to the lender.

3. **Market Conditions**: Interest rates fluctuate based on the broader economic environment. When the Federal Reserve raises or lowers rates, it can impact home equity loan rates.

4. **Loan Amount and Term**: The size of the loan and the repayment term can also affect the interest rate. Generally, larger loans or longer terms may come with slightly higher rates.

#### How to Compare Home Equity Loan Percentage Rates

When considering a home equity loan, it’s essential to compare rates from multiple lenders. Here are some tips for effectively comparing rates:

- **Get Quotes**: Reach out to several lenders to obtain quotes. Make sure to ask for the annual percentage rate (APR), which includes both the interest rate and any associated fees.

- **Consider Fees**: Some lenders may offer lower rates but charge higher fees, which can negate the savings. Always factor in any closing costs or origination fees when comparing offers.

- **Look for Discounts**: Some lenders offer discounts for automatic payments or for existing customers. It’s worth asking about any potential savings.

#### Conclusion

Understanding **home equity loan percentage rates** is vital for making informed borrowing decisions. By considering factors such as your credit score, LTV ratio, and current market conditions, you can better navigate the lending landscape. Always compare rates from multiple lenders and consider the overall cost of the loan, including fees, to ensure you get the best deal possible. With the right information and preparation, a home equity loan can be a valuable resource for funding major expenses, such as home renovations, education costs, or debt consolidation.