Pre Approval Mortgage Loan Calculator: A Comprehensive Tool for Homebuyers

In the ever-evolving world of real estate, the quest for the perfect home is a journey fraught with financial planning and strategic decision-making. Enter……

In the ever-evolving world of real estate, the quest for the perfect home is a journey fraught with financial planning and strategic decision-making. Enter the pre-approval mortgage loan calculator, a beacon of guidance for those navigating the complexities of the home buying process. This powerful tool serves as a cornerstone for homebuyers, offering a streamlined path to financial security and peace of mind.

The pre-approval mortgage loan calculator is more than just a simple financial aid; it's a strategic ally in the home buying process. By providing a pre-approval letter, this calculator allows potential homeowners to understand their financial capacity and limitations before they even step foot in their dream home. This invaluable insight is crucial for making informed decisions, as it ensures that a home purchase aligns with one's financial goals and capabilities.

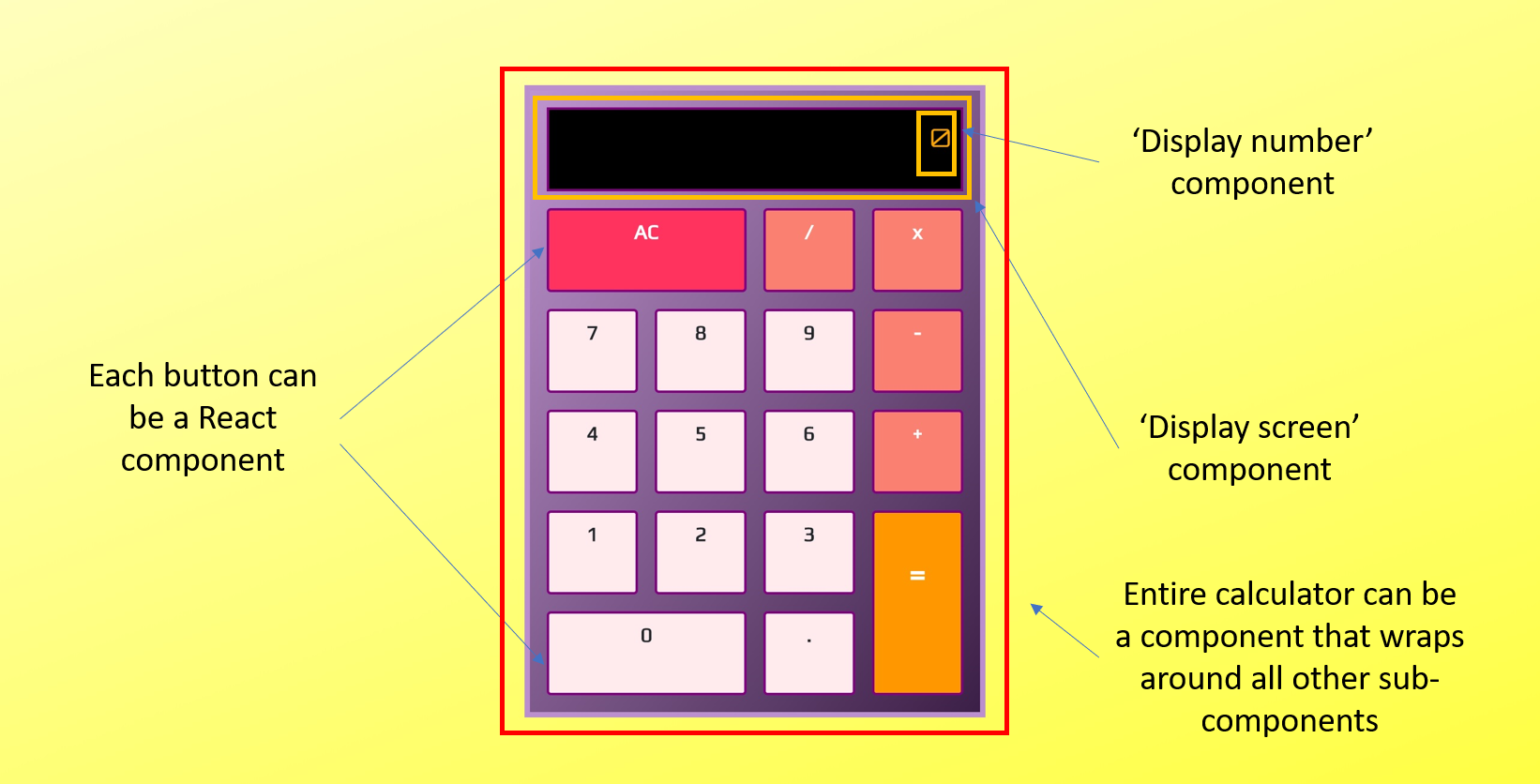

The calculator operates on a user-friendly interface, making it accessible to a wide range of individuals, from first-time homebuyers to seasoned investors. It requires minimal input, asking for basic information such as income, debts, and desired loan amount. With this data, the calculator swiftly processes the information, providing a pre-approval amount that matches the buyer's financial profile.

One of the most significant advantages of using a pre-approval mortgage loan calculator is its impact on the home buying process. It streamlines negotiations with sellers, as it provides a clear, unambiguous figure that the buyer is financially capable of affording. This pre-approval letter acts as a powerful tool, instilling confidence in sellers and accelerating the closing process.

Furthermore, the pre-approval mortgage loan calculator offers a glimpse into potential homeowners' creditworthiness. By analyzing the provided financial information, the calculator assesses the applicant's ability to repay the loan, thereby providing an early indication of creditworthiness. This proactive approach to credit evaluation is invaluable, as it allows buyers to address any potential credit issues before they become deal-breakers.

The pre-approval mortgage loan calculator also serves as an educational resource for homebuyers. It offers insights into the intricacies of the mortgage process, such as the impact of interest rates, loan terms, and down payment amounts on affordability. This knowledge is crucial for making informed decisions, as it enables buyers to navigate the complexities of the mortgage market with confidence.

In conclusion, the pre-approval mortgage loan calculator stands as a testament to the power of technology in simplifying complex financial processes. It serves as a strategic ally for homebuyers, offering a comprehensive toolkit for navigating the home buying journey. With its user-friendly interface, strategic insights, and educational value, the pre-approval mortgage loan calculator is an indispensable asset for anyone embarking on the quest for their dream home. Whether you're a first-time buyer or a seasoned investor, this calculator is your key to financial security and a home that truly feels like your own. Embrace the pre-approval mortgage loan calculator, and take the first step towards your dream home with confidence and clarity.