Calculator Loan Mortgage: Simplifying Your Home Financing

Homeownership is a significant milestone in many people's lives, symbolizing stability, growth, and the pursuit of the American Dream. However, the journey……

Homeownership is a significant milestone in many people's lives, symbolizing stability, growth, and the pursuit of the American Dream. However, the journey to purchasing a home can be daunting, especially for those unfamiliar with the complexities of mortgage loans. This is where the loan mortgage calculator comes into play, serving as a crucial tool to demystify the mortgage process and make informed decisions.

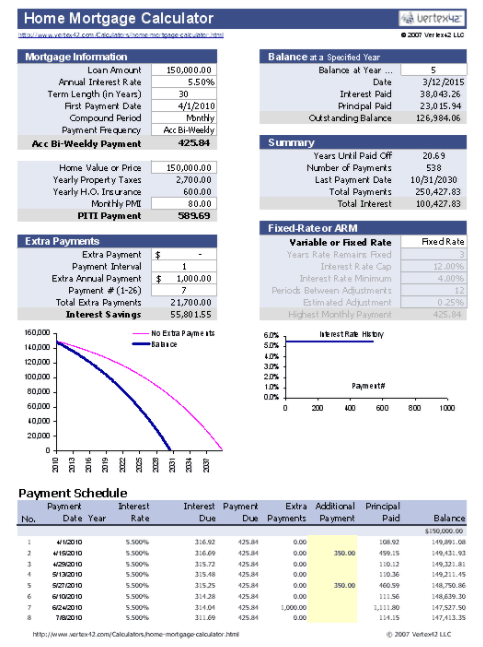

A mortgage calculator is an indispensable resource for anyone planning to buy a home. It helps you estimate your monthly mortgage payments based on various factors, such as the loan amount, interest rates, and the term of the loan. By inputting these variables into the calculator, you can get a clear picture of how much your mortgage will cost, helping you plan your finances accordingly.

When it comes to mortgages, the term "loan mortgage" is particularly relevant. It refers to the amount of money borrowed from a lender to purchase a home. This loan is secured by the property itself, meaning the lender has a claim on the home until the loan is repaid. Understanding the concept of a loan mortgage is crucial for anyone considering homeownership, as it sets the foundation for the financial planning involved in the process.

The loan mortgage calculator is designed to make this process more accessible and manageable. By using the calculator, you can explore different loan options, such as fixed-rate mortgages, adjustable-rate mortgages (ARMs), and government-backed loans. Each type of mortgage has its own set of advantages and disadvantages, and the calculator helps you weigh these options based on your financial goals and risk tolerance.

One of the most significant benefits of using a loan mortgage calculator is the ability to customize your mortgage scenario. You can adjust the loan amount, down payment, and interest rate to see how these factors affect your monthly payments and overall loan cost. This level of customization allows you to make informed decisions that align with your financial situation and long-term goals.

Another advantage of using a loan mortgage calculator is the peace of mind it provides. By accurately estimating your mortgage payments, you can avoid surprises and ensure that you are financially prepared for homeownership. This is particularly important in the early years of your mortgage, when your payments are primarily applied to interest.

In addition to providing estimates for monthly mortgage payments, the loan mortgage calculator can also help you understand the impact of different loan terms on your overall costs. For example, a longer loan term, such as 30 years, may result in lower monthly payments but higher overall interest costs. Conversely, a shorter loan term, such as 15 years, may result in higher monthly payments but lower overall interest costs. The calculator helps you explore these trade-offs and make the best decision for your financial situation.

Moreover, the loan mortgage calculator can assist in budgeting for other homeownership expenses beyond the mortgage itself. By estimating property taxes, insurance, and maintenance costs, you can get a comprehensive view of your overall home ownership expenses. This helps you plan your finances more effectively and ensures that you are prepared for all aspects of homeownership.

In conclusion, the loan mortgage calculator is a powerful tool that can simplify the process of buying a home and make it more accessible to a wider range of individuals. By providing accurate estimates of mortgage payments and helping you explore different loan options, the calculator empowers you to make informed financial decisions. Whether you are a first-time homebuyer or considering a new home, the loan mortgage calculator is an essential resource to guide you through the homeownership journey with confidence and clarity.

When using the loan mortgage calculator, it's important to remember that these estimates are based on the information you provide. To get the most accurate results, enter your specific details, such as the loan amount, interest rate, and loan term. Additionally, consider consulting with a financial advisor or mortgage professional to discuss your options and make the best decision for your unique financial situation.

By leveraging the loan mortgage calculator, you can navigate the complexities of homeownership with confidence, making informed decisions that align with your financial goals and long-term aspirations. So, whether you are just starting your journey or looking to make a change, the loan mortgage calculator is a valuable tool to help you achieve your dream of homeownership.