Loans for School Students: Transforming Educational Opportunities with Financial Aid

Guide or Summary:Understanding the Role of Student Loans in EducationTypes of Student Loans AvailableApplying for Student Loans: A Comprehensive GuideRepaym……

Guide or Summary:

- Understanding the Role of Student Loans in Education

- Types of Student Loans Available

- Applying for Student Loans: A Comprehensive Guide

- Repayment Strategies and Loan Forgiveness Programs

In the ever-evolving landscape of education, the pursuit of higher learning remains a beacon of hope and ambition for countless students worldwide. However, the financial burden that accompanies this journey can often deter even the most determined individuals. This is where loans for school students become a pivotal tool in democratizing access to education. By providing a means for students to finance their educational aspirations, these loans not only offer a lifeline but also pave the way for a brighter future.

Understanding the Role of Student Loans in Education

Student loans serve as a crucial financial lifeline for students, enabling them to pursue higher education without the immediate need for substantial personal savings or financial backing from family members. These loans are designed to cover the cost of tuition, books, and other educational expenses, making it possible for students from diverse socio-economic backgrounds to access quality education.

The importance of student loans cannot be overstated. They play a pivotal role in reducing the economic barriers to education, ensuring that talent and potential are not stifled by financial constraints. By providing students with the opportunity to invest in their future, these loans foster a more equitable and inclusive educational environment.

Types of Student Loans Available

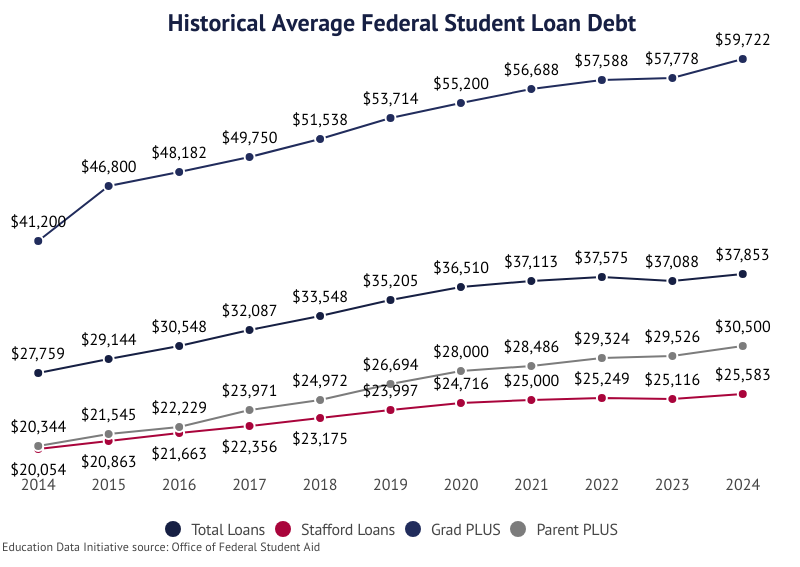

There are several types of student loans available to students, each with its unique features and benefits. Federal student loans, for instance, are backed by the government and offer favorable repayment terms, including income-based repayment plans that can make loan payments more manageable for borrowers. Private student loans, on the other hand, are offered by financial institutions and may provide additional funding beyond federal loan limits, but they often come with higher interest rates and stricter repayment terms.

Applying for Student Loans: A Comprehensive Guide

Applying for student loans involves several steps, including filling out the Free Application for Federal Student Aid (FAFSA) and exploring available loan options. Students should carefully consider their financial situation and educational goals when applying for loans, as different types of loans may be more suitable depending on individual circumstances.

It is also essential for students to understand the terms and conditions of their loans, including interest rates, repayment periods, and any associated fees. Keeping these details in mind can help students make informed decisions about their educational financing and ensure they are well-prepared for repayment.

Repayment Strategies and Loan Forgiveness Programs

Repaying student loans can be a daunting task, but there are strategies and programs available to help make the process more manageable. Income-driven repayment plans adjust monthly loan payments based on the borrower's income and family size, providing flexibility and relief for those who may struggle to meet their repayment obligations.

Additionally, loan forgiveness programs offer the possibility of forgiving a portion of a borrower's loan balance after they have made a certain number of qualifying payments or meet specific criteria related to public service or teaching.

Loans for school students are a vital component of the educational landscape, offering a lifeline to those who aspire to achieve higher levels of education. By providing financial support, these loans help bridge the gap between educational aspirations and financial reality, ensuring that talent and potential are not stifled by financial constraints. As the cost of education continues to rise, the role of student loans in democratizing access to education becomes ever more crucial. With careful planning and a clear understanding of available options, students can navigate the complex world of student loans and embark on their educational journeys with confidence and hope.