Understanding Your Student Loan Total Debt: A Comprehensive Guide to Managing and Reducing Your Financial Burden

#### Student Loan Total DebtStudent loan total debt refers to the cumulative amount of money that borrowers owe across all their student loans. This figure……

#### Student Loan Total Debt

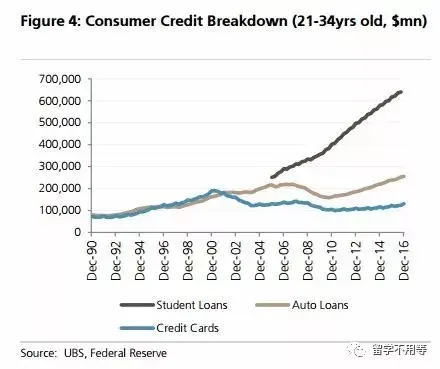

Student loan total debt refers to the cumulative amount of money that borrowers owe across all their student loans. This figure can vary significantly from one individual to another, depending on various factors such as the type of institution attended, the degree pursued, and the financial aid received. In the United States, student loan debt has reached alarming levels, with millions of graduates facing burdensome repayment schedules that can last for decades.

#### Understanding the Components of Student Loan Total Debt

To effectively manage your student loan total debt, it is essential to understand its components. Student loans can be classified into two main categories: federal loans and private loans. Federal loans are funded by the government and often come with benefits such as lower interest rates and flexible repayment options. In contrast, private loans are offered by banks and financial institutions, typically carrying higher interest rates and less favorable terms.

When calculating your student loan total debt, you should consider both the principal amount borrowed and the interest accrued over time. Interest rates can vary widely, and even a small difference can lead to significant changes in the total amount repaid over the life of the loan. Additionally, borrowers should be aware of any fees associated with their loans, as these can also contribute to the total debt amount.

#### The Impact of Student Loan Total Debt on Financial Health

Carrying a high student loan total debt can have far-reaching consequences on an individual's financial health. For many graduates, student loans are the first significant debt they encounter, and managing this debt can be challenging. High monthly payments can limit the ability to save for other financial goals, such as buying a home or investing for retirement. Furthermore, the stress associated with debt can impact mental health and overall well-being.

Many borrowers may also experience difficulty in securing other forms of credit due to their student loan total debt. Lenders often consider debt-to-income ratios when assessing creditworthiness, and high student loan payments can negatively affect this ratio. This can make it more challenging to obtain mortgages, car loans, or credit cards, further complicating financial stability.

#### Strategies for Managing and Reducing Student Loan Total Debt

Managing student loan total debt requires a proactive approach. Here are several strategies borrowers can employ to reduce their financial burden:

1. **Create a Budget**: Establishing a monthly budget can help borrowers track their expenses and allocate funds toward loan payments. Prioritizing student loan payments can prevent falling behind and incurring additional interest.

2. **Explore Repayment Options**: Federal student loans offer various repayment plans, including income-driven repayment plans that adjust monthly payments based on income. Understanding these options can help borrowers choose a plan that fits their financial situation.

3. **Consider Loan Consolidation or Refinancing**: Borrowers with multiple loans may benefit from consolidating their loans into a single payment. Refinancing can also lower interest rates, reducing the total amount of interest paid over time.

4. **Make Extra Payments**: Whenever possible, making additional payments toward the principal can significantly reduce the total debt. Even small extra payments can have a substantial impact over the life of the loan.

5. **Stay Informed About Forgiveness Programs**: Some borrowers may qualify for student loan forgiveness programs, particularly those working in public service or certain non-profit sectors. Researching eligibility requirements can provide relief for those struggling with high student loan total debt.

#### Conclusion

In conclusion, understanding your student loan total debt is critical for effective financial management. By recognizing the components of this debt, its impact on financial health, and employing strategic repayment methods, borrowers can take control of their financial future. With the right approach, it is possible to navigate the challenges of student loan debt and work toward a more secure financial position.