Comprehensive Guide to Using the 7000 Loan Payment Calculator for Your Financial Planning

#### Understanding the 7000 Loan Payment CalculatorIn today's financial landscape, managing loans effectively is crucial for maintaining a healthy budget. O……

#### Understanding the 7000 Loan Payment Calculator

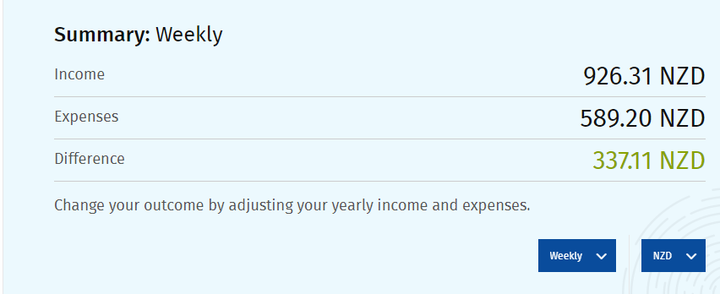

In today's financial landscape, managing loans effectively is crucial for maintaining a healthy budget. One tool that can significantly aid in this process is the **7000 loan payment calculator**. This calculator allows borrowers to estimate their monthly payments based on the loan amount, interest rate, and term length. By providing a clear picture of what to expect, it empowers individuals to make informed decisions about their borrowing options.

#### How the 7000 Loan Payment Calculator Works

The **7000 loan payment calculator** operates on a straightforward principle: it takes into account the principal amount (in this case, $7,000), the interest rate, and the loan term (the duration over which the loan will be repaid). Users simply input these variables, and the calculator generates monthly payment amounts. This process is not only quick but also provides an immediate understanding of the financial commitment involved in taking out a loan.

#### Benefits of Using a 7000 Loan Payment Calculator

1. **Budgeting**: One of the primary benefits of using a **7000 loan payment calculator** is that it helps individuals budget effectively. Knowing the exact monthly payment allows borrowers to allocate their finances accordingly, ensuring they can meet their obligations without straining their budget.

2. **Comparison Shopping**: With the ability to adjust the interest rate and loan term, users can experiment with different scenarios. This feature enables borrowers to compare various loan offers, helping them identify the most cost-effective option available.

3. **Financial Planning**: By understanding the implications of a $7,000 loan, borrowers can plan for future expenses. Whether it's for education, home improvements, or other personal needs, knowing the payment structure aids in long-term financial planning.

#### How to Use the 7000 Loan Payment Calculator Effectively

To get the most out of the **7000 loan payment calculator**, follow these steps:

1. **Gather Information**: Before using the calculator, gather all necessary information, including the loan amount, expected interest rate, and desired loan term.

2. **Input Data**: Enter the gathered information into the calculator. Make sure to double-check your figures for accuracy.

3. **Analyze Results**: Once the calculator provides the monthly payment amount, take time to analyze how this fits into your overall financial picture. Consider additional costs such as insurance, taxes, and any other fees associated with the loan.

4. **Make Adjustments**: If the monthly payment exceeds your budget, consider adjusting the loan term or seeking a lower interest rate. The calculator allows for these adjustments, providing a flexible approach to finding the right loan.

#### Conclusion

In conclusion, the **7000 loan payment calculator** is an invaluable tool for anyone considering taking out a loan. By simplifying the process of estimating monthly payments, it enhances financial literacy and empowers borrowers to make sound financial decisions. Whether you're planning for a significant purchase or managing existing debt, leveraging this calculator can lead to better financial outcomes. Take the time to explore your options and use the calculator to its full potential, ensuring that your borrowing aligns with your financial goals.