Unlocking Financial Opportunities: A Comprehensive Guide to the Wells Fargo Loan Department

#### Wells Fargo Loan DepartmentThe **Wells Fargo Loan Department** plays a pivotal role in providing financial solutions to individuals and businesses alik……

#### Wells Fargo Loan Department

The **Wells Fargo Loan Department** plays a pivotal role in providing financial solutions to individuals and businesses alike. As one of the largest financial institutions in the United States, Wells Fargo offers a diverse range of loan products tailored to meet the needs of its customers. Whether you are looking to purchase a new home, refinance an existing mortgage, or secure a personal loan for unforeseen expenses, understanding the offerings of the **Wells Fargo Loan Department** can help you make informed financial decisions.

#### Types of Loans Offered

At the **Wells Fargo Loan Department**, customers can access various types of loans, including:

1. **Mortgage Loans:** Wells Fargo provides a variety of mortgage options, including fixed-rate and adjustable-rate mortgages. These loans cater to first-time homebuyers, veterans, and those looking to refinance their existing mortgages.

2. **Personal Loans:** For those in need of quick cash for personal expenses, Wells Fargo offers unsecured personal loans that can be used for anything from medical bills to home improvements.

3. **Auto Loans:** If you're in the market for a new or used vehicle, the **Wells Fargo Loan Department** provides competitive auto loan options with flexible terms.

4. **Home Equity Lines of Credit (HELOC):** Homeowners can tap into their home equity with HELOCs, allowing for flexible borrowing against the value of their home.

5. **Small Business Loans:** The **Wells Fargo Loan Department** also supports entrepreneurs with various financing options designed to help small businesses grow and thrive.

#### Application Process

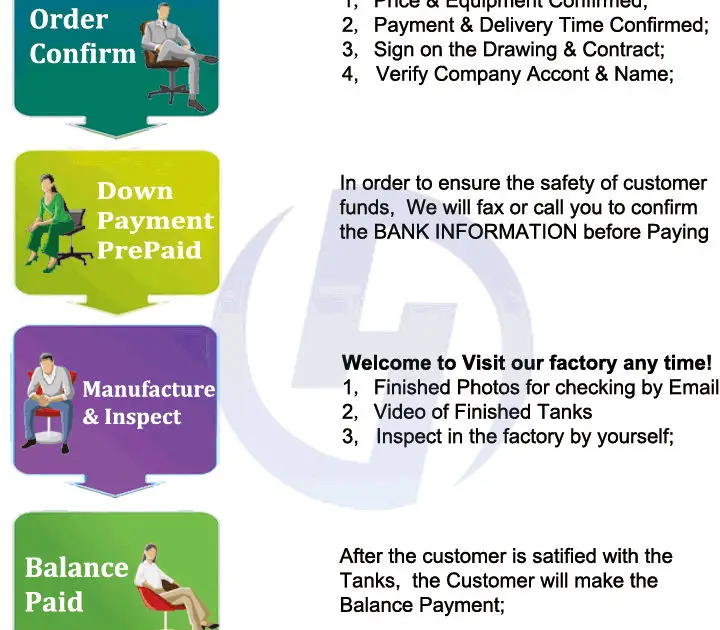

Navigating the loan application process can be daunting, but Wells Fargo aims to simplify it for its customers. Here’s a step-by-step breakdown of what to expect when applying for a loan through the **Wells Fargo Loan Department**:

1. **Prequalification:** Start by prequalifying for a loan to understand how much you can borrow and what your monthly payments may look like. This step does not affect your credit score.

2. **Gather Documentation:** Prepare necessary documents such as proof of income, credit history, and any other financial information required for the specific loan type.

3. **Submit Application:** Complete your application online or in-person at a local Wells Fargo branch.

4. **Loan Review:** The **Wells Fargo Loan Department** will review your application and assess your creditworthiness.

5. **Loan Approval:** If approved, you will receive a loan offer detailing terms, interest rates, and repayment schedules.

6. **Closing:** Once you accept the offer, you’ll proceed to closing, where you’ll sign the loan agreement and receive your funds.

#### Customer Support and Resources

Wells Fargo is committed to providing excellent customer service. The **Wells Fargo Loan Department** offers various resources to assist customers throughout their loan journey. From online calculators to estimate monthly payments to dedicated loan officers who can answer your questions, the bank ensures you have the support you need.

#### Conclusion

In conclusion, the **Wells Fargo Loan Department** is a valuable resource for anyone seeking financial assistance. With a wide range of loan products, a straightforward application process, and dedicated customer support, Wells Fargo aims to empower its customers to achieve their financial goals. Whether you are buying your first home, financing a vehicle, or managing personal expenses, the **Wells Fargo Loan Department** is equipped to help you navigate your financial journey effectively.