Understanding Closing Costs for FHA Loan: A Comprehensive Guide for Homebuyers

#### Closing Costs for FHA LoanWhen considering purchasing a home with an FHA loan, understanding the **closing costs for FHA loan** is crucial. These costs……

#### Closing Costs for FHA Loan

When considering purchasing a home with an FHA loan, understanding the **closing costs for FHA loan** is crucial. These costs can significantly affect the overall affordability of your home purchase. In this article, we will explore what closing costs are, how they apply to FHA loans, and provide tips on how to manage these expenses effectively.

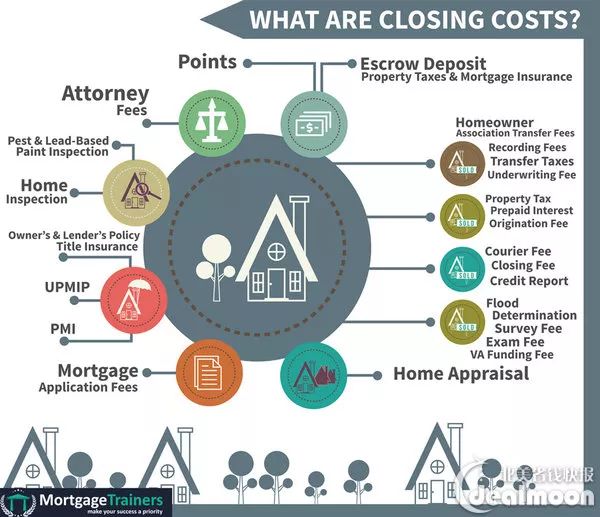

#### What Are Closing Costs?

Closing costs refer to the fees and expenses that buyers and sellers incur during the final steps of a real estate transaction. These costs can include a variety of charges, such as loan origination fees, appraisal fees, title insurance, and attorney fees, among others. Typically, closing costs range from 2% to 5% of the purchase price of the home, which can add up to a substantial amount depending on the value of the property.

#### Specifics of Closing Costs for FHA Loans

FHA loans, backed by the Federal Housing Administration, are designed to help low-to-moderate-income borrowers qualify for a mortgage. While FHA loans offer several advantages, such as lower down payment requirements, they also come with specific closing costs that borrowers should be aware of.

1. **Loan Origination Fees**: This fee is charged by the lender for processing the loan application. It can vary but is typically around 1% of the loan amount.

2. **Appraisal Fees**: An appraisal is necessary to determine the market value of the property. FHA loans require a specific type of appraisal, which can cost more than a standard appraisal.

3. **Title Insurance**: This protects against any defects in the title of the property. It is a one-time fee that can vary based on the property’s value and location.

4. **Home Inspection Fees**: While not always required, a home inspection is highly recommended to uncover any potential issues with the property. The cost can vary based on the size and condition of the home.

5. **Prepaid Costs**: These include property taxes, homeowners insurance, and mortgage interest that need to be paid upfront at closing.

6. **Government Fees**: FHA loans may also include various government fees, such as the mortgage insurance premium (MIP), which is required for all FHA loans.

#### How to Estimate Closing Costs for FHA Loans

To estimate your closing costs for an FHA loan, start by calculating 2% to 5% of the home's purchase price. This will give you a rough estimate of the total costs you might incur. Additionally, request a Loan Estimate from your lender, which provides a detailed breakdown of the anticipated closing costs.

#### Tips for Managing Closing Costs

1. **Shop Around**: Different lenders may offer varying fees for closing costs. It’s wise to compare offers from multiple lenders to find the best deal.

2. **Negotiate Fees**: Some closing costs are negotiable. Don’t hesitate to discuss these fees with your lender or real estate agent to find potential savings.

3. **Consider Seller Contributions**: In some cases, sellers may be willing to cover a portion of the closing costs as part of the negotiation process.

4. **Look for Assistance Programs**: Many states and local governments offer down payment assistance programs that can also help cover closing costs.

5. **Budget for Prepaid Expenses**: Remember to factor in prepaid expenses when budgeting for your closing costs. These can add to the total amount needed at closing.

In conclusion, understanding the **closing costs for FHA loan** is essential for any prospective homebuyer. By being informed and prepared, you can navigate the closing process with confidence and ensure that you are making a sound financial decision in your journey toward homeownership.