Understanding Delinquent Loans: Causes, Consequences, and Solutions for Financial Recovery

Guide or Summary:Delinquent LoanDelinquent LoanIn the world of finance, the term delinquent loan refers to a loan that has not been paid back according to t……

Guide or Summary:

Delinquent Loan

In the world of finance, the term delinquent loan refers to a loan that has not been paid back according to the terms agreed upon in the loan contract. When a borrower fails to make a scheduled payment, the loan becomes delinquent. This can happen for various reasons, including financial hardship, loss of income, or unexpected expenses. Understanding the implications of a delinquent loan is crucial for both borrowers and lenders, as it can significantly affect credit scores, financial stability, and future borrowing capabilities.

### Causes of Delinquent Loans

There are several factors that can lead to a delinquent loan. One of the most common reasons is a sudden change in the borrower’s financial situation. For example, job loss or medical emergencies can strain an individual’s finances, making it difficult to meet loan obligations. Additionally, poor financial planning or lack of budgeting can result in missed payments.

Another significant factor is the type of loan taken out. Certain loans, like payday loans or high-interest personal loans, can quickly become unmanageable if the borrower does not have a stable source of income. Furthermore, borrowers may not fully understand the terms of their loans, leading to unintentional delinquency when payments are due.

### Consequences of Delinquent Loans

The consequences of having a delinquent loan can be severe. One of the most immediate impacts is on the borrower’s credit score. A delinquent loan can lead to a decrease in creditworthiness, making it difficult to secure future loans or credit. This can create a vicious cycle, as borrowers may need to rely on high-interest loans to manage their financial situations, further exacerbating their debt.

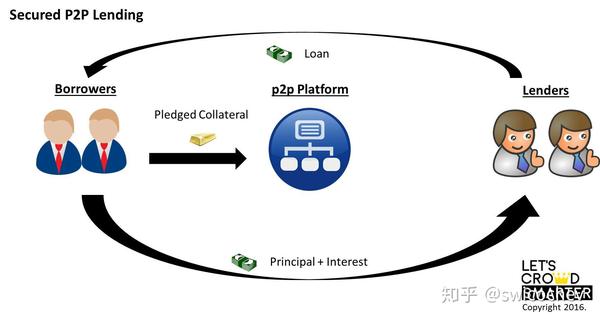

Moreover, lenders often take action when a loan becomes delinquent. This can include late fees, increased interest rates, and potential legal action to recover the owed amount. In extreme cases, the lender may initiate foreclosure or repossession of collateralized assets, leading to significant financial loss for the borrower.

### Solutions for Managing Delinquent Loans

If you find yourself facing a delinquent loan, it’s essential to take proactive steps to manage the situation. The first step is to communicate with your lender. Many lenders are willing to work with borrowers who are experiencing temporary financial difficulties. They may offer options such as loan modification, forbearance, or a repayment plan that can help you get back on track.

Additionally, it’s crucial to assess your financial situation. Create a budget to understand your income and expenses better. Identify areas where you can cut costs to allocate more funds toward your loan payments. Seeking assistance from a financial advisor or a credit counseling service can also be beneficial. These professionals can provide guidance on managing debt and improving your financial literacy.

### Conclusion

In summary, a delinquent loan can have serious implications for borrowers, affecting their credit scores and financial health. Understanding the causes and consequences of delinquency is vital for anyone who has taken out a loan. By taking proactive measures and seeking help when needed, borrowers can navigate the challenges of delinquent loans and work towards financial recovery. Remember, it’s never too late to seek assistance and take control of your financial future.